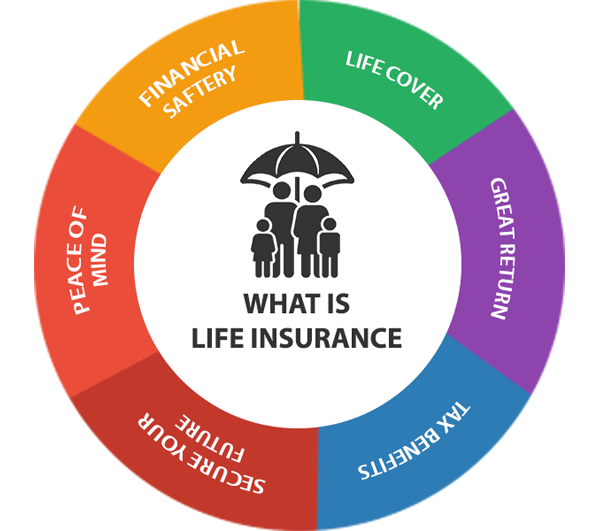

Life Insurance

Life insurance is an agreement between you and an insurer, ensuring a financial payout, known as a death benefit, to chosen beneficiaries — usually loved ones — after your death. If your policy is active and premiums are up to date, the benefit will be provided.